Facebook pronounces Libra cryptocurrency: All it’s worthwhile to know

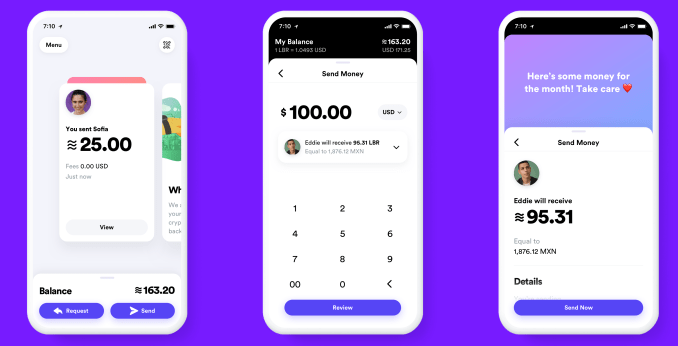

Facebook has finally divulged the details of its cryptocurrency Libra, which will let you buy concepts or move fund to parties with virtually zero fees. You’ll pseudonymously buy or cash out your Libra online or at neighbourhood exchange objects like grocery stores, and deplete it exploiting interoperable third-party wallet apps or Facebook’s own Calibra wallet that will be built into WhatsApp, Messenger, and its own app. Today Facebook released its white paper explaining Libra and its testnet for works out the cricks of its blockchain plan before a public start in the first three months of 2020.

Facebook won’t fully limit Libra, but instead get precisely a single vote in its governance like other founding members of the Libra Association including Visa, Uber, and Andreessen Horowitz who’ve devoted at least $ 10 million each into the project’s operations. The association will promote the open-sourced Libra blockchain and developer scaffold with its own Move programming language plus sign up businesses to accept Libra for fee and even open patrons discounts or rewards.

Facebook is launching a subsidiary company likewise called Calibra that handles its crypto dealings and protects users’ privacy by never combining your Libra payments with your Facebook data so it can’t be used for ad targeting. Your real identity won’t be bind to your publicly evident deals. But Facebook/ Calibra and other founding members of the Libra Association will give interest on the money consumers cash in that is held in reserve to keep the value of Libra stable.

Facebook’s audacious proposal to create a world digital money that promotes monetary inclusion for the unbanked actually has more privacy and decentralization built in than countless expected. Instead of trying to dominate Libra’s future or squeezing tons of cash out of it immediately, Facebook is instead playing the long-game by gathering payments into its online realm. Facebook’s VP of blockchain David Marcus justified the company’s motive and the tie-in with its core receipt root during a briefing at San Francisco’s historic Mint building.” If more commerce happens, then more small and medium-sized businesses will sell more on and off platform, and they’ll want to buy more ads on the pulpit so it will be good for our ads business .”

The Risk And Reward Of Building The New PayPal

In cryptocurrencies, Facebook visualized both security threats and new opportunities. They braced the promise of disrupting how things are bought and sold by eliminating transaction costs common with credit cards. That comes dangerously close to Facebook’s ad business that influences what is bought and sold. If a challenger like Google or an upstart built a popular coin and could monitor the transactions, they’d learn what beings buy and could muscle in on the billions spent on Facebook marketing. Meanwhile, the 1.7 billion people who lack a bank account might elect whoever offers them a financial services alternative as their online identity provider more. That’s another thing Facebook wants to be.

Yet existing cryptocurrencies like Bitcoin and Ethereum weren’t properly engineered to scale to be a medium of exchange. Their unanchored price was suggestible to huge and irregular fluctuates, obligating it tough for sellers to accept as fee. And cryptocurrencies miss out on much of their potential beyond speculation unless there are enough locates that will take them instead of dollars, and its own experience of buying and spending them is easy enough for a mainstream gathering. But with Facebook’s tie-in with 7 million advertisers and 90 million small and medium-sized businesses plus its user know prowess, it was well poised to tackle this juggernaut of a problem.

Now Facebook wants to reach Libra the evolution of PayPal. It’s hoping Libra will become simpler to set up, more pervasive as a payment method, more efficient with fewer rewards, more accessible to the unbanked, more flexible thanks to developers, and more long-lasting through decentralization.

” Success will mean that a person working abroad has a fast and simple way to send money to lineage back home, and a college student can pay their rent as easily as they can buy a coffee” Facebook copies in its Libra documentation. That would be a big improvement on today, when you’re stuck paying rent in insecure checks while exploitative remittance business like blame an average of 7% to send coin abroad, making $50 billion from consumers annually. Libra could also power tiny microtransactions worth simply a few pennies that are infeasible with credit card rewards fixed, or supersede your pre-paid transit pass.

…Or it could be globally turn a blind eye to purchasers who see it as too much hassle for too little reward, or extremely unfamiliar and limited in use to pull them into the modern business landscape. Facebook has built a stature for over-engineered, underused commodities. It will need all the help it can get if wants to replace what’s already in our pockets.

How Does Libra Work?

By now you know the basics of Libra. Cash in a regional money, come Libra, deplete them like dollars without big-hearted transaction costs or your real identify appended, currency them out when you are crave. Feel free to stop reading and share this article if that’s all you care about. But the underlying technology, the association that determines it, the pouches you’ll use, and the lane pays drive all have a huge amount of fascinating detail to them. Facebook has liberated over 100 sheets of documentation on Libra and Calibra, and we’ve pulled out the most important happenings. Let’s dive in.

The Libra Association- Crypto’s New Oligarchy

Facebook knew people wouldn’t trust it to absolutely steering the cryptocurrency “theyre using”, and it also demanded help to spur adoption. So the social network banked the founding members of the Libra Association, a not-for-profit which oversees the development of the sign, the fund of real-world assets that generates it importance, and the governance terms and conditions of the blockchain.” If well ensure it, very few people would want to jump on and make it theirs” says Marcus.

Each founding member paid a minimum of $ 10 million to join and optionally become a validator node operator( more on that last-minute ), gain one vote in the Libra Association committee, and be available to a share( proportionate to their investment) of the bonus from interest income earned on the Libra reserve useds compensate fiat currency into to receive Libra.

The 28 soon-to-be founding members of the association and their manufactures, previously reported by The Block’s Frank Chaparro, include 😛 TAGEND

Payments: Mastercard, PayPal, PayU( Naspers’ fintech weapon ), Stripe, Visa Technology and marketplaces: Booking Supports, eBay, Facebook/ Calibra, Farfetch, Lyft, Mercado Pago, Spotify AB, Uber Engineering, Inc. Telecommunications: Iliad, Vodafone Group Blockchain: Anchorage, Bison Trails, Coinbase, Inc ., Xapo Holdings Limited Venture Capital: Andreessen Horowitz, Breakthrough Initiatives, Ribbit Capital, Thrive Capital, Union Square Ventures Nonprofit and multilateral organizations, and academic institutions: Imaginative Devastation Lab, Kiva, Mercy Corps, Women’s World Banking

Facebook says it hopes to reach 100 founding members before the official Libra launch and it’s open to anyone that converges the requirements including direct opponents like Google or Twitter. The Libra Association is based in Geneva, Switzerland and will converge biannually. The country was chosen for its neutral status and strong expressed support for business invention including blockchain technology.

Libra Governance- Who Does A Vote

To join the association, members must have a half rack of server room, a 100 Mbps or above dedicated internet linkage, a full-time site reliability engineer, and enterprise-grade security. Firms must smack two of three thresholds of a$ 1 billion USD market value or $500 million in purchaser balances, contact 20 million people a year, and/ or be recognized as a top 100 manufacture ruler by the working group like Interbrand Global or the S& P.

Crypto-focused investors must have over$ 1 billion in assets under administration, while Blockchain enterprises must have been in business for a year, have endeavor point security and privacy, and incarceration or staking larger than $ 100 million in resources. And simply up to one-third of founding members can by crypto-related businesses or individually invited objections. Facebook also accepts study parties like universities, and non-profits fulfilling three of four characters including working on business inclusion for over five years old, multi-national reach to lots of users, a top 100 classification by Charity Navigator or something like it, and/ or $50 million in budget.

The Libra Association will be responsible for picking banking more founding members to act as validator nodes for the blockchain, fundraising to jumpstart the ecosystem, designing incentive programs to reward early adopters, and aiding out social impact grants. A parliament with a representative from each member will help choose the association’s managing director who will appoint an exec team, elect a board of 5 to 19 top representatives.

Each member including Facebook/ Calibra will merely get up to one referendum or 1% of the total vote( whichever is larger) in the Libra Association congres. This plies a statu of decentralization that protects against Facebook or any other player hijacking Libra for its own gain. By avoiding sole ownership and sovereignty over Libra, Facebook could eschew additional scrutiny from regulators who are already investigating it for a ocean of privacy abuses as well as potentially anti-competitive behavior. In an attempt to preempt criticism from lawmakers, the Libra Association creates” We welcome public investigate and accountability. We are committed to a dialogue with regulators and policymakers. We share policymakers’ interest in the ongoing stability of national currencies .”

The Libra Currency- A Stablecoin

A Libra is a unit of the Libra cryptocurrency that’s represented by a three wavy horizontal route unicode character [?] like the dollar is represented by $. The value of a Libra is meant to stay principally stable so it’s a good medium of exchange since merchants can be confident they won’t be paid a Libra today that’s then worth less tomorrow. The Libra’s value is restrained to a basket of bank deposits and short-term government protections for a batch of historically stable international currencies including the dollar, pound, euro, swiss franc, and yen. The Libra Association maintains this basket of assets and can change the balance of its composition if necessary to offset major toll waverings in any one foreign currency so that the added advantage of a Libra stays consistent.

A Libra is a unit of the Libra cryptocurrency that’s represented by a three wavy horizontal route unicode character [?] like the dollar is represented by $. The value of a Libra is meant to stay principally stable so it’s a good medium of exchange since merchants can be confident they won’t be paid a Libra today that’s then worth less tomorrow. The Libra’s value is restrained to a basket of bank deposits and short-term government protections for a batch of historically stable international currencies including the dollar, pound, euro, swiss franc, and yen. The Libra Association maintains this basket of assets and can change the balance of its composition if necessary to offset major toll waverings in any one foreign currency so that the added advantage of a Libra stays consistent.

The name Libra comes from the word for a Roman division of weight asses. It’s trying to cite a sense of financial free by playingon the French stem “Lib” implication free.

The Libra Association is still hammering out the exact start price for the Libra, but it’s meant to somewhere close to the value of a dollar, euro, or pound so it’s easy to conceptualize. That practice, a gallon of milk in the US might expense 3 to 4 Libra, same but not exactly the same as with dollars.

The idea is that you’ll cash in some money and hinder a balance of Libra that you can spend at acquiring shopkeepers and online services. You’ll be able to trade in your neighbourhood money for Libra and vice versa through certain wallet apps including Facebook’s Calibra, third-party wallet apps, and local resellers like amenity or grocery stores where people once go to top-up their mobile data plan.

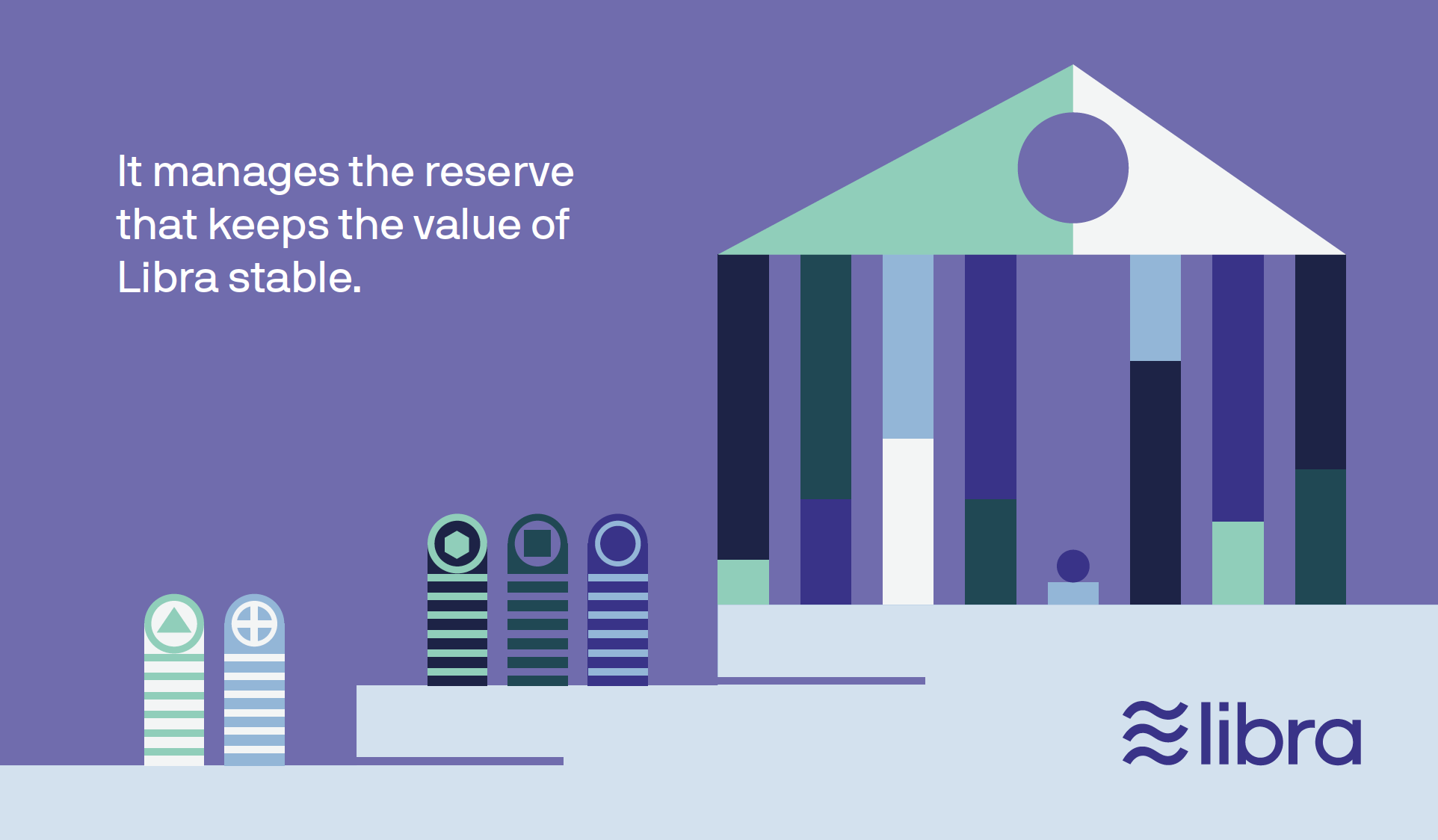

The Libra Reserve- One For One

Each time someone cashes in a dollar or their respective regional currency, that fund goes into the Libra Reserve and an equivalent importance of Libra is minted and doled out to that person. If someone cashes out from the Libra Association, the Libra they give back are destroyed/ burned and they receive the equivalent cost in their neighbourhood currency back. That wants there’s always 100% of the value of the Libra in circulation collateralized with real world assets in the Libra Reserve. It never ranges fractional. And unliked “pegged” stable coppers that are bind to a single currency like the USD, Libra maintains its own value — though that should cash out to approximately the same amount of a handed money over time.

When Libra Association representatives affiliate and pay their $ 10 million minimum, they receive Libra Investment Tokens. Their share of the total tokens translates into the proportion of the dividend they deserve off of interest on resources in the modesty. Those gains are only paid out after Libra Association helps interest to pay for operating expenses, investing in the ecosystem, engineering experiment, and gifts to non-profits and other organizations. The best interest has been one of what enticed the Libra Association’s members. If Libra becomes favourite and many people carry a large balance of the money, the reserve will grow huge and earn substantial interest.

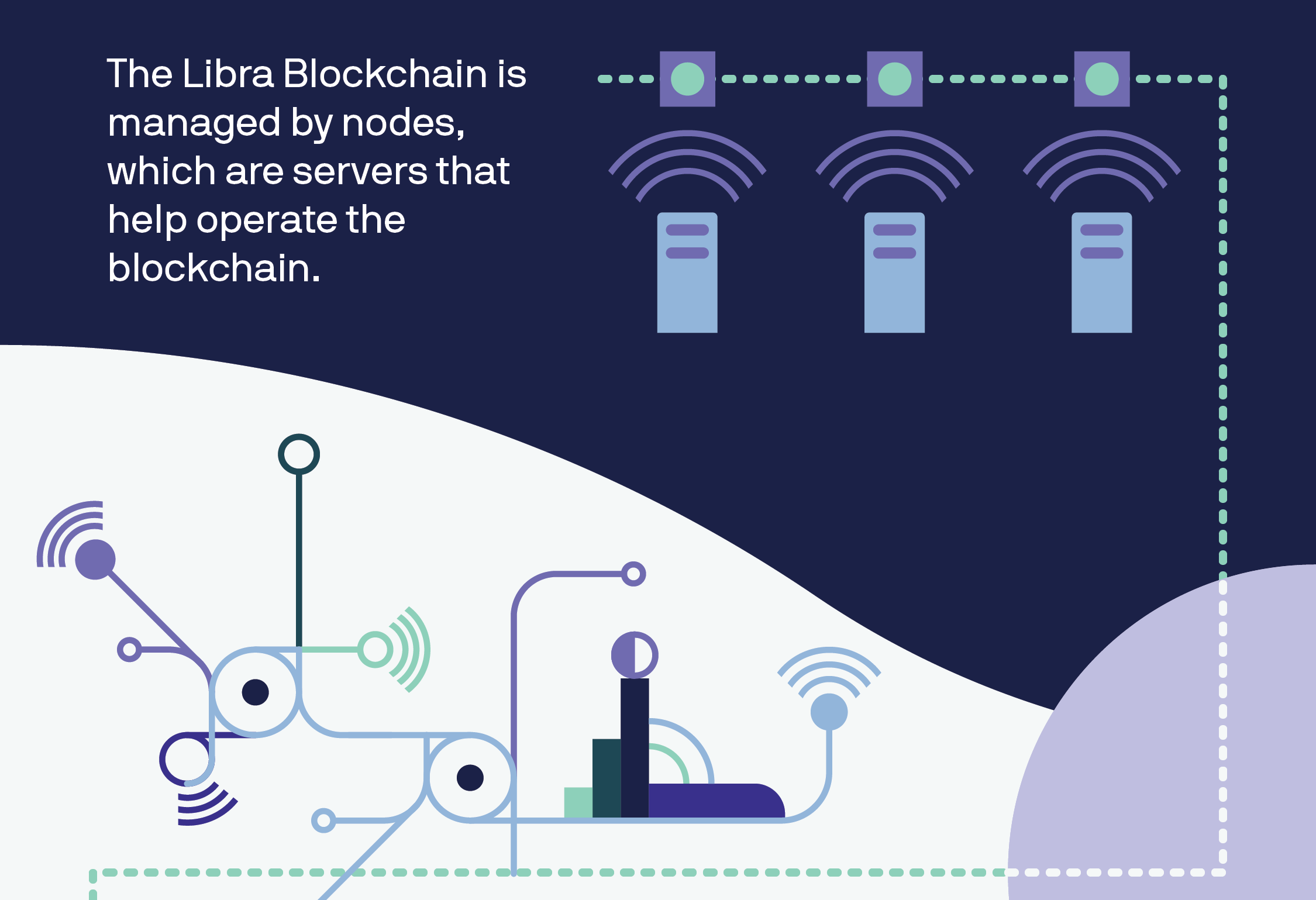

The Libra Blockchain- Built For Speed

Every Libra payment is permanently written into the Libra blockchain — a cryptographically certified database that acts as a public online ledger designed to handle 1000 events per second. That would be much faster than Bitcoin’s 7 business per second or Bitcoin’s 15. The blockchain is operated and perpetually verified by founding members of the Libra Association who each endowed $10 million or more for a say in the cryptocurrency’s governance and the ability operate a validator node.

When a transaction is submitted, each of the nodes extends a calculation based on the existing ledger of all business. Thanks to a Byzantine Fault Tolerance system, just two-thirds of the nodes must come to consensus that the transaction is legitimate for it to be executed and written to the blockchain. A structure of Merkle Trees in the system starts it simple to recognize modifies made to the Libra blockchain. With 5KB deals, 1000 proofs per second proofs on commodity CPUs, and up to 4 billion accounts, the Libra blockchain should be able to operate at 1000 business per second if nodes us at least 40 Mbps linkages and 16 TB SSD hard drives.

Transactions on Libra cannot be overruled. If an attack settlements over one-third of the validator nodes effecting a forking in the blockchain, the Libra Association says it will temporarily halt transactions, figure out the extent of the damage, and recommend software updates to solve the fork.

Transactions aren’t totally free. They incur a small fraction of a penny fee to pay for ” gas” that covers the cost of processing the transfer of stores similar to with Ethereum. This cost will be negligible to most customers, but when they add up the gas bills will restrain bad actors from procreating millions of transactions to power spam and denial-of-service strikes.” We’ve intentionally tried not to innovate massively on the blockchain itself because we want it to be scalable and safe” says Marcus of piggybacking on very good elements of existing cryptocurrencies.

Currently, the Libra blockchain is what’s known as “permissioned”, where merely entities that fulfill certain requirements and are admitted to a special in-group that defines consensus and controls governance of the blockchain. The trouble is this structure is more vulnerable to attacks and censoring because it’s not rightfully decentralized. But during Facebook’s experiment, it couldn’t find a reliable permissionless structure that have been able to securely scale to the number of transactions Libra will need to handle. Adding more nodes brakes occasions down, and no one has proven a nature to avoid that without jeopardizing security.

That’s why the Libra Association’s goal is to move to a permissionless organisation based on proof-of-stake that will protect against attacks by distributing control, promote competition, and lower the barrier to entryway. It wants to have at least 20% of votes in the Libra Association congres coming from node adventurers based on their total Libra restrains instead of their status as a founding member. That intention should help to appease blockchain purists who won’t be satisfied until Libra is completely decentralized.

Move Coding Language- For Moving Libra

The Libra blockchain is open root with an Apache 2.0 license and any developer can build apps that work with it expend the Move coding language. The blockchain’s prototype launches its testnet today, so it’s effectively in make beta procedure until it officially propels in the first half of 2020. The Libra Association is working with HackerOne to propel a glitch recompense structure later this year that will pay security investigates for safely linking flaws and hitches. In the meantime, the Libra Association is implementing the Libra Core applying the Rust programming language since it’s designed to prevent security vulnerabilities, and the Move language isn’t amply ready yet.

Move was created to make it easier to write blockchain code that are consistent with an author’s meaning without innovating glitches. It’s called Move because its primary capacity is to move Libra coins from one account to another, and never let those resources be accidentally replication. The core transaction system is like: LibraAccount.pay_from_sender( recipient_address, quantity) procedure

Eventually, Move developers will be able to create smart contracts for programmatic interactions with the Libra blockchain. Until Move is ready, makes is generated by modules and event writes for Libra use Move IR, which is high-level enough to be human-readable but low-level enough to be translatable into real Move bytecode that’s written to the blockchain.

The Libra ecosystem and the Move language will be completely open to use and improved, which presents a sizable likelihood. Crooked developers could prey on crypto newcomers, claiming their app wreaks just the same legitimate ones, and that it’s safe since it employs Libra. But if buyers get ripped off by these scammers, the anger will definitely bubble up to Facebook. Yet still, Calibra’s head of commodity tells me” There are no a blueprint for the LibraAassociation to take a role in actively vetting[ developers ].”

Even though it’s tried to interval itself sufficiently via its subsidiary Libra and the association, many people is more likely to ever think of Libra as Facebook’s cryptocurrency and condemn it for their woes.

Libra Motivations- Reinforcing Early Businesses

The Libra Association wants to encourage more developers and sellers to work with its cryptocurrency. That’s why it plans to issue motivations, perhaps Libra silvers, to validator node operators who can get people signed up for and using Libra. Billfold that pull users through the Know Your Customer anti-fraud and money laundering process or that keep users sufficiently active for over a year will be rewarded. For each event they process, brokers will also receive percentages per of the busines back.

Businesses that deserve these incentives can keep them, or pass some or all of them along to users in the form of free Libra clues or discounts on their purchases. This could create competition between wallets to see which can pass the most compensations on to their purchasers, and thereby attract the most useds. You could imagine eBay or Spotify giving you a dismis for paying in Libra, while wallet developers might give you free tokens if you accomplish 100 business within a year.

“One challenge for Spotify and its customers around the world has been the lack of easily accessible payment organisations- especially for those in financially underserved sells” Spotify’s Bos Premium Business officer Alex Norstrom author.” In to intervene in the Libra Association, there is an opportunity to better reach Spotify’s total addressable busines, eliminate resistance and enable pays in mass scale.”

This savvy incentive system should massively help ratchet up Libra’s user count without dictating how businesses balance their perimeters versus increment. Facebook also has another plan to grow its make ecosystem. By offering venture capital firms like Andreessen Horowitz and Union Square Ventures a portion of the reserve interest, they’re prompt to fund startups building Libra infrastructure.

Employ Libra

So how do you actually own and expend Libra? Through Libra pocketbooks like Facebook’s own Calibra and others that will be built by third-parties, potentially including Libra Association representatives like PayPal. The sentiment is to form referring money to a friend or paying for something as easy as sending a Facebook Message. You won’t be able to originate or receive any real remittances until the official launch next year, though, but you can sign up for early access when it’s ready now.

None of the Libra Association representatives agreed to provide details on what exactly they’ll build on the blockchain, but we can take Facebook’s Calibra wallet as an example of the basic experience. Calibra will propel alongside the Libra currency on iOS and Android within Facebook Messenger, WhatsApp, and a standalone app. When customers first sign up, they’ll be taken through a Know Your Customer anti-fraud process where they’ll have to provide a government issued photo ID and other proof info. They’ll need to conduct due diligence on customers and report questionable act to the authorities.

From there you’ll be able to cash in to Libra, select a friend or merchant, given an amount to send them and supplemented job descriptions, and send them Libra. You’ll too be able to request Libra, and Calibra will give an expedited road of compensating brokers by scanning your or their QR code. Eventually it wants to offer in-store remittances and consolidations with Point-Of-Sale structures like Square.

The Libra Association’s ecommerce representatives seem particularly elicited about how the sign could eliminate transaction fees and speed up checkout.” We imagine blockchain will benefit the luxury industryby improving IP protection, clarity in the make lifecycle and- as in the case of Libra- enable world-wide frictionless e-commerce” says FarFetch CEO Jose Neves.

Privacy- At Least From Facebook

Facebook CEO Mark Zuckerberg explained some of the relevant principles behind Libra and Calibra in a post today.” It’s decentralized — definition it’s run by many different organizations instead of really one, originating the system fairer overall. It’s available to anyone who knows an internet contact and has low-grade costs and costs. And it’s secured by cryptography which helps keep your money safe. This is an important part of our imagination for a privacy-focused social programme — where you can interact in all the ways you’d want privately, from messaging to fasten payments .”

By default, Facebook won’t import your contacts or any of your sketch information but may ask if you wish to do so. It likewise won’t share any of your transaction data back to Facebook, so it won’t used to target you with ads, grade your News Feed, or otherwise make Facebook money directly. Data will only be shared in particular instance in anonymized routes for experiment or ratification calculation, for hunting down fraudsters, or due to a request from law enforcement. And you don’t even need a Facebook or WhatsApp account to sign up for Calibra or to use Libra.

” We realise parties don’t want their social data and business data commingled” says Marcus, who’s now head of Calibra.” The reality is we’ll have plenty of wallets that will compete with us and many of them will not be in social, and if we want to successfully earn people’s cartel, we have to make sure the data will be separated .”

In case you are hacked, scammed, or lose access to your history, Calibra will refund you for lost coins when probable through 24/7 chat aid because it’s a custodial pouch. You too won’t should also be borne in mind any long, complex crypto passwords you have been able forget and get locked out from your money, since Calibra oversees all your keys for you. Given Calibra will likely become the default wallet for numerous Libra useds, this additional shield and smoother used event is essential.

For now, Calibra won’t make money. But Weil tells me that if it contacts scale, Facebook could propel other monetary tools through Calibra that it could monetize such as investing or lending.” In time, we hope to offer added servicing of parties and transactions, such as paying legislations with the push of a button, buying a cup of coffee with the scan of a system, or razzing your regional public transit without needing to carry currency or a metro pass” the Calibra team scribbles. That attains it start to seemed a lot like China’s everything app WeChat.

Today, Facebook is coming together with 27 parties various regions of the world to start the non-profit Libra Association and…

Posted by Mark Zuckerberg on Tuesday, June 18, 2019

A Global Coin

Facebook got one thing right for sure: today’s fund doesn’t work for everyone. Those of us living comfortably in developed people likely don’t see the sufferings that befall migrant workers or the unbanked abroad. Preyed on by greedy payday lenders and high-fee remittance services, targeted by muggers, and left out of traditional financial services, the poor get poorer. Libra has the potential to get more fund from working parents back to their families and help people retain credit even if they’re cheated of their physical self-possessions. That would do more to accomplish Facebook’s mission of offsetting the world feel smaller than all the News Feed Likes combined.

If Facebook supersedes and brigades of parties cash in money for Libra, it and the other founding members of the Libra Association could deserve big dividends on the interest. And if abruptly it becomes super quick to buy occasions through Facebook exerting Libra, businesses will improve their ad spend there. But if Libra gets spoofed or proves inaccurate, it could cost lots of people around the world money while souring them on cryptocurrencies. And by offering an open Libra platform, shady developers could build apps that give not just people’s personal info like Cambridge Analytica, but their hard-earned digital cash.

Facebook precisely tried to reinvent money. Next year, we’ll see if the Libra Association can pull it off. It took me 4000 messages to explain Libra, but at least now you can make up your own mind about whether to be scared of Facebook crypto.

Read more: techcrunch.com